As with most debit card airline rewards programs this year, Citibank recently announced they’ll be ending mileage-earning capabilities December 9, 2011. It’s no longer profitable for banks to bestow mileage on us for our checking account debit purchases due to the Durbin Amendment. I’m sad to see this perk go and the cost for buying the miles from the airlines must obviously be greater than the revenue banks earn from our transactions (or is it?).

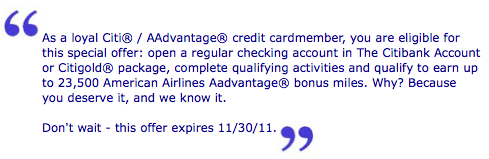

Today I received an offer in the mail, and while targeted given the fact I have a Citi American Airlines AAdvantage Visa credit card, anyone with the same card qualifies for this promotion and possibly more (see below). It reads:

It further mentions:

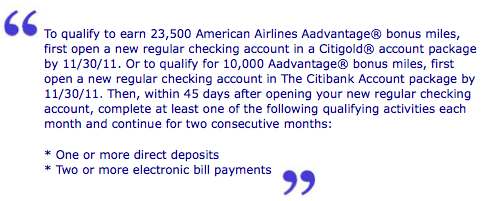

It further mentions:

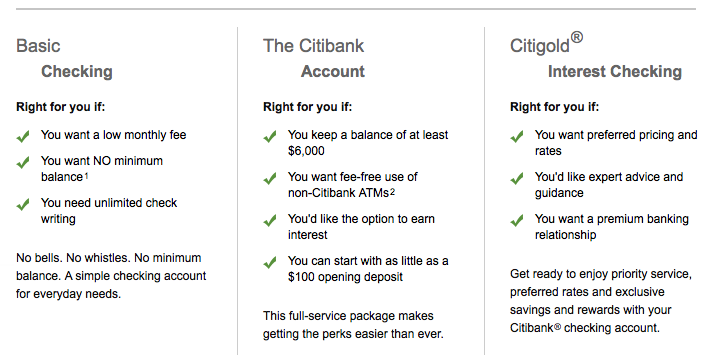

The checking accounts it refers to don’t come cheaply. Minimum balances to avoid monthly fees are steep, in my opinion.

The checking accounts it refers to don’t come cheaply. Minimum balances to avoid monthly fees are steep, in my opinion.

The cheapest option that’ll get you 10,000 bonus miles is The Citibank Account, which requires a minimum $6,000 average daily balance to avoid the $20 monthly service fee and requires a minimum opening deposit of $100 (no biggie there, of course). For what it’s worth, purchasing 10,000 miles currently costs $275 and you could certainly gain that mileage far cheaper if you’re Platinum or above by doing a simple mileage run. The pricier Citigold® interest-bearing checking account requires a minimum of $50,000 or more in all linked deposit or retirement accounts, or additional mortgage amount requirements you can review on their website here. If you don’t maintain that level, you’d be charged a $30 monthly fee.

The cheapest option that’ll get you 10,000 bonus miles is The Citibank Account, which requires a minimum $6,000 average daily balance to avoid the $20 monthly service fee and requires a minimum opening deposit of $100 (no biggie there, of course). For what it’s worth, purchasing 10,000 miles currently costs $275 and you could certainly gain that mileage far cheaper if you’re Platinum or above by doing a simple mileage run. The pricier Citigold® interest-bearing checking account requires a minimum of $50,000 or more in all linked deposit or retirement accounts, or additional mortgage amount requirements you can review on their website here. If you don’t maintain that level, you’d be charged a $30 monthly fee.

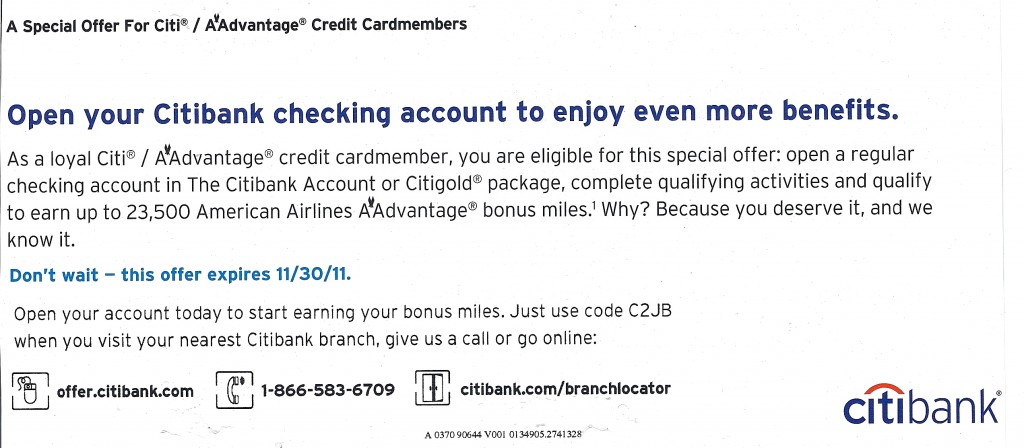

Again, you “have†to be a Citi credit cardmember in order to qualify, but your mileage may vary since I’m posting the offer code of C2JB. When you go to offer.citibank.com and enter the code, it just proceeds as normal without seemingly validating anything.

The terms state, “The AAdvantage® bonus miles will be credited to your AAdvantage® account within 90 days from the end of the statement period in which you meet all qualifying requirements stated in this offer.†So, if this appeals to you and you have the dough to allocate for a couple of months, it would be an easy way to rack up some miles – almost enough for a free roundtrip domestic coach ticket – given the terms explicitly state you must maintain the requirements for “two consecutive months.â€

Mr. Pickles posted this months ago. Yes, the min balances are very steep. One false move, and they slam you for steep fees, too.

Signed up 6/22. No miles yet. Would not do this again or recommend it. At least the checking fees haven’t hit yet, but I’m not looking forward to paying those fees while waiting for miles that may never post, not to mention a 1099 showing up next year to pay tax on $587.50.

I opened a checking account with 6k and did the required transactions to receive 10,000 AA miles. Then 5 weeks later I get a letter in the mail saying the minimum balance requirement to avoid a $20 monthly fee was being increased by 150% to $15,000. After this bait and switch tactic I promptly closed the account. They even wanted to charge me a $25 fee to close the account which I protested to the manager and got twaived.

Had I simply left the funds in the Bank direct account I would have saved a lot of hassle and also received 1000 miles for having those funds on deposit there.

So if you want a hassle and a headache , go for it.

Worked for me! They didn’t even charge a monthly fee. Just got the check today from closing the acct.

I did this when it was posted a few months ago by someone else. I was not targeted for the promotion. Got 27,500 miles from it that just posted this week (the 4,000 extra was for getting the Citigold debit card for the account). It was linked to my Citibank mortgage so the fees were waived. You can also link your AA credit card to it and your cc annual fee is waived as well for as long as the acct is open. I would say it is worth it only if you have a Citibank mortgage or the extra dough sitting around. If you do it and were not targeted, maybe go in person to open the account and have the teller manually add in the code…that is what I did and the miles posted without me having to follow-up. 🙂