Most airline reviews posted in the mainstream media are traveler-based specifically focusing on the opinions of the end-user. Earlier this month, Business Travel News published the results from its 14th annual Airline Survey of 716 corporate travel managers and buyers, of which 406 represent or manage the accounts of companies who spend in excess of $500,000 annually. The majority of those 406 spend more than $12 million each year.

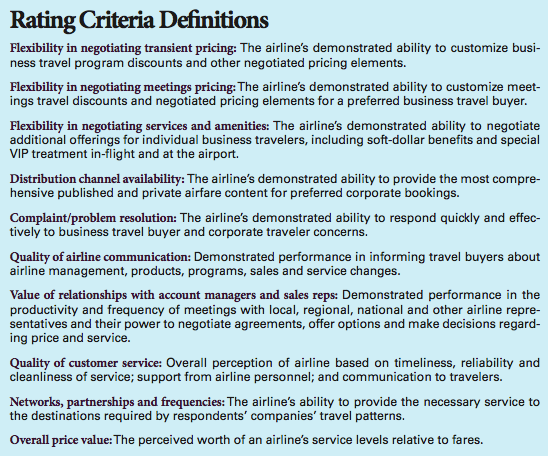

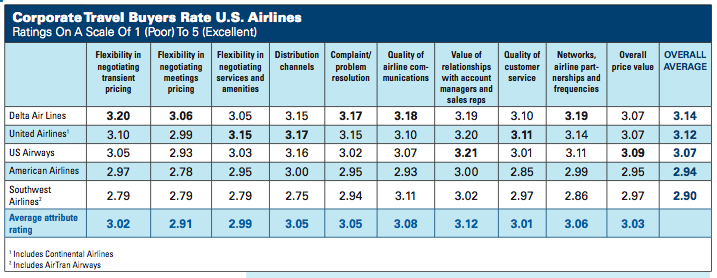

In my opinion the results reveal a different side to the industry many don’t normally consider – the contracted and often private fare airline clients. This year, Delta Air Lines beat out Continental Airlines earning the highest ratings overall, and winning five out of the 10 total service delivery categories scored. Here are those categories:

Image courtesy Business Travel News

It’s important to note just how different some of them are when compared to traditional airline reviews, as you and I generally don’t have contracted rates with negotiated pricing or deal with a dedicated account manager. Here, then, are the results from corporate buyers:

Southwest generally scores pretty high in consumer end-user satisfaction, but it appears they’re not winning many purchasers over on the corporate contract front coming in last of the five surveyed. Some other tidbits revealed by airline:

Delta Air Lines:

- Finishing fourth last year, travel managers are saying the carrier started listening to companies and have become more flexible.

- Delta itself states they’ve empowered their sales agents to be more collaborative and have enhanced client reporting.

- Rolling out Economy Comfort, more flatbed seats and offering Wi-Fi on its entire domestic fleet also won high marks.

United Airlines:

- Truth be told, United came in fifth last year (Continental was #1) and the report states, “The new United already may be harnessing Continental’s history of goodwill in the corporate marketplace.â€

- United acknowledges the challenges the merger brings and claims there’s “an enormous amount of work to do†on corporate customer programs.

- Even with merger pains, the carrier took the #1 spot in service & amenity flexibility, distribution channels and quality of customer service (which sort of surprises me as the description of that category is pretty much on par with how we travelers rate the carrier – often not taking the top spot).

US Airways:

- The carrier claims it is shedding their previous position as a “low-cost†carrier after they acquired America West and have been ramping up their sales department to compete with those of the legacy network carriers. They gained 100 new North American accounts in the past year.

- As such, they’ve increased their sales force by 50% in North America (up to 42 people) and have expanded internationally in Brussels, Zurich, Ireland and Scandinavia.

- They took #1 in “overall price value,†which doesn’t surprise me since they actually still match many of Spirit’s fares whereas no other major generally does in the markets I monitor.

American Airlines:

- American came in second last year, but a combination of their financial position, perceived value of network and alliance partnerships and distribution woes moved them into fourth place this year.

- Here’s a disparity from my experiences with them this year – they came in last in quality of customer service. Either I had the most exceptional crews, airport agents and phone interactions this year or this category might be more skewed to being specific to the sales teams and related support personnel (unlike the way it sounds in the above description).

Southwest Airlines:

- Southwest is sort-of unique to compare to these other carriers from a corporate travel perspective, but they did take third place last year. This year, not so much as travel managers find their lack of negotiated discounts and third-party distribution channels a pressing point.

- Their merger with AirTran is also of importance to many corporate planners. AirTran had a fairly differentiated product with advance seat assignments, a premium cabin and actually went after corporate clients. It’s unclear Southwest’s direction concerning corporate accounts so far with the merger.

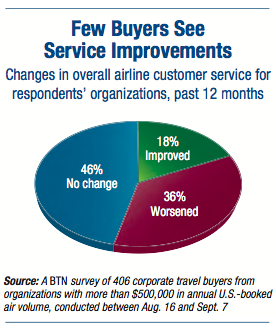

Consumers and travel managers both agree on one thing, however. Service improvements are scarce and most have seen no improvement with many finding things worse off than in the past. This pretty much mirrors consumer sentiment today:

Image courtesy Business Travel News

I held positions at two different travel companies where we negotiated with the airlines on these types of contracts, so I always have a keen interest in following how that industry has been evolving. I read one article where United no longer offers bulk pricing contracts to wholesale travel distributors, but need to do more research into that before assuming it’s industry-wide. If true, look for a post soon on how that changes the game for many popular travel operators.

These rankings are often in striking contrast to many consumer-based reviews, but it shows off the importance contracts with top spending travel management companies can provide to an airline’s bottom line, an area not often reviewed on BoardingArea.

Not surprising that WN is in last place – they only compete half-heartedly in this market place with their primary focus being on selling tickets to occasional travellers.

I disagree with what you say about surprise that UA rates so highly on service and the perception of UA in the consumer market place. UA has for many years thrown its service muscle at frequent flyers and its service to them has always been very good. The same applies to beneficiaries of corporate contracts. The flip side is the occasional traveller who suffers from severe neglect. The mainstream media fails to make (or even see) this distinction and thus misreports the issue. After all, if UA were as bad as the media suggests, they wouldn’t have nearly as much business as they do – it’s not a monopoly and there are plenty of competitors for pretty well all of their major routes.

When I worked with United’s Sales team at one company I worked with, they were stellar. The reason I was surprised UA took top spot for service is based on the hugely inconsistent service I’ve received as a passenger, whether on the phone, at the airport or onboard. While I only flew AA about 16 times this year, they excelled, and I’ve heard Delta’s top-tier elites are very happy with the service they receive.