[Updated: This offer had expired.]

In case you haven’t already read about the new Citi Platinum Select / AAdvantage Visa Signature card from other bloggers, here’s the scoop. This card has now become more competitive in terms of ancillary benefits compared to previous iterations and those cards of competing airlines, such as the Chase United Airlines Explorer card.

Here are the details:

- Earn 30,000 American Airlines AAdvantage bonus miles after $1,000 in purchases within the first three months of membership.

- Free first checked bag for you and up to four traveling companions.

- Priority Boarding privileges and 25% off in-flight food, beverages and headsets.

- Earn a $100 American Airlines flight discount every year if you spend $30,000 or more each year on your card.

- Receive double AAdvantage miles on eligible American Airlines purchases.

- Earn 10% of your redeemed AAdvantage miles back, up to 10,000 miles per year.

The standard variable APR for this card is 15.24%, similar to the previous Citi/AAdvantage Visa Signature card, and the annual fee is $95/year after the first year of free membership.

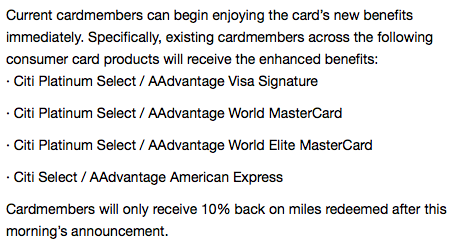

Fellow blogger AAdvantage Geek reached out to his contacts at American and found out current Citi AAdvantage cardholders will qualify for these new perks effective today – except the 30,000 mileage bonus as an existing cardholder – if they hold the following cards:

While the 30K mileage bonus isn’t as phenomenal as previous offers, the other new benefits are generous if you meet the criteria.

While the 30K mileage bonus isn’t as phenomenal as previous offers, the other new benefits are generous if you meet the criteria.

You can read the full fine print and sign up for this card here.

I receive a small commission if you get approved for a card by using the links in this post. I remain grateful for any who do and can confirm that I myself have a Citi AAdvantage Platinum Select Visa Signature card. I’m quite pleased with it and the bonus miles I received helped me redeem miles for a First Class trip to Hong Kong.

The real rub here is the lack of Million Miler accrual. When American Airlines announced that change, the terms of the game changed, too. Now, instead of a card that earns AAdvantage miles that when I redeem and fly on I earn nothing towards status, it really seems to make more sense to use something like the Capital One VentureMiles card, the Chase Sapphire card or the Amex Gold Rewards card that allow you to earn points and redeem them for paid travel that accrues Elite Qualifying and Million Miler miles. The AAdvantage cards are getting better benefits, but as long as they only earn redeemable miles, the “travel points” cards that redeem into paid fares just seem like better deals.

I received an offer for MC and Visa cards for 30K miles after $750 spend. Can you find out if the same benefits are added to these offers also? They are both business card’s. Thank you for any info.

https://www.citicards.com/cards/acq/Apply.do?app=UNSOL&sc=6VVZBXR2&m=3QAEZMAZZZW&langId=EN&siteId=BAO&B=V&screenID=3006

this is the link for the 30K biz card

@Mike Reed: Yeah, the million miler change hurt those used to earning on that basis.

@Evan: For the card you linked to, it doesn’t appear to be a business version of the ones I listed in this post that will get the benefits extended. I’m unsure as to your other card. Sorry I couldn’t be more helpful!

can you explain how the points are converted to paid airfare? I guess they work for domestic & international tickets the same way, since its $.

for international flights, 75K miles gets a round trip to asia on AAdvantage, which is around $1300 in fare, 110K miles nets a business class seat. how much $ is 75k & 110k points worth?

@DJ: The miles earned each month from your purchases get deposited into you AAdvantage account for which you then redeem for awards – not paid travel. Currently, the MileSAAver rate to Japan is 65,000 miles roundtrip in economy and 100,000 in business; China and other parts of Asia is 70,000 miles in economy and 110,000 in business. Valuation of your miles can be subjective, actually, but most put it at around $0.02/mile or just a little lower than that. Otherwise, the miles aren’t really converted into a $$ value by the airline.

Thanks for the quick reply. to clarify, I was referring to

Capital One VentureMiles & Chase Sapphire mentioned by Mile in response #1. from his post it seems to me the points were redeemed into $$ instead of AA miles. if i spend $6k per month, after 1 yr I’d have 72k points or miles, depending on the type of cards. although 72k points redeem into paid ticket which earns EQM & MMM, the better deal might be the 72k miles which would get a round trip ticket to Asia whose $$ value could be higher than 72k points. this depends on the conversion of points into $$. I am wondering how much the points are worth.

@DJ: Ah, gotcha… didn’t look back to Mike’s comment. I’m not familiar with those cards, but… did just look up the Capital One card. It looks like 100 miles = $1. The example on their website reads that if you see a fare for $189, you’d need 18,900 miles from that program to redeem for the ticket. The Chase Sapphire program is much more popular with many travelers and I need to find out why! Sorry I don’t know more about it.

Hi thanks for the update.

at 100 to 1 ratio, points do not seem to make sense for some type of global travel. for ex. round trip business class to Hong Kong is 110k miles at AA. This would normally cost $3000+ minimum. So you’d need 300K points, versus 110K miles – HUGE difference given the unit cost of points & miles are the same, or even at 2-1.

it all depends on your travel preference.

You need to qualify that the “first checked bag” does NOT include international flights. I had to pay both ways to toronto.

@elliot: Thanks for the info – I’ll be sure to clarify on newer posts featuring this card.