An article about Alaska Airlines appeared in last week’s Los Angeles Times that I think is worth a read. It quotes CEO Bill Ayer as basically saying Alaska is not for sale nor interested in a merger, effectively shunning away any courtship attempt from another carrier or entity. They do have codeshare arrangements with both American Airlines & Delta Air Lines, but Ayer’s goal is to stay independent.

Speculation has been frequent by analysts that Alaska would be an ideal acquisition for a number of large carriers, including American, Delta & US Airways, as well as other midsize carriers such as Frontier, Hawaiian, JetBlue & Spirit. According to Ayer again though, while Alaska knows growth is essential for its continued success (telling investors to expect 3% to 6%), it can do so by adding frequency in some of the markets it currently only serves once or twice a day. The carrier for the foreseeable future is staying away from the recent trend of mergers in the industry.

Financially, Alaska is doing quite well and posted a net income of $29.5 million ($74.2 million GAAP) for the first quarter of 2011. Its stock price is strong when compared against the industry, too, and the company would be valued as being worth $2.5 billion dollars on that basis alone. Scott Kirby, President of US Airways, acknowledges Alaska’s success and even points out that a merger between the two would, “take a cost structure that’s profitable and make it unprofitable.”

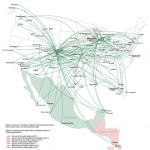

Still, though, from a route perspective I can see why investors would find the marriage of Alaska and other midsize airlines attractive, making such a combination into another large U.S. carrier to compete with the legacies domestically. Take a look at the route maps of Alaska (ex-Seattle), Frontier (complete route map) and JetBlue (ex-New York/Boston).

Also from what I’ve seen, Alaska receives fairly high marks in customer satisfaction, and will very soon have fleet-wide Wi-Fi capability given a tweet I saw from them on Friday. I’ve never flown with Alaska, but did have good experiences when I’ve flown subsidiary Horizon Air in the past. In a shrinking industry through consolidation, it was interesting to read the remarks from an airline CEO decisively against mergers… for now.

Also look at the Hawaiian Airlines route map. It fits pretty neatly into that puzzle also,

and provides links beyond Hawaii to North Asia, Phillipines, Australia, and the South Pacific.

It does directly compete with Alaska on the (SEA-HI) routes, however.

Passengers would find it useful to be able to have code-share flights, coordination on connecting flight times, and cross-airline frequent flier earning/redemption among those 4 airlines.

Hi AC,

Hawaiian would be another reasonable fit, yes. If Alaska were to merge with someone down the line, I’d suspect their first interest would lie with expanding their network mainly within the contiguous U.S. The other carriers are definitely appealing in that respect, although fleet commonality certainly isn’t a match. JetBlue+Frontier would be a nice Airbus combo, now wouldn’t it?

The similarities between the way Alaska and JetBlue operate – except for the fleet plans – is eerily similar. Alaska has more FF partners but JetBlue is growing interline partners at least and seems inclined to add FF partners at some point, too.

Beyond that, however, the fleet size, annual revenue, average stage length and passenger makeup are quite similar. Really very similar. If it weren’t for the fact that their fleets were completely different the combination would quite quickly be a serious competitor in the regional travel market.